12 Options Of Quickbooks Point-of-sale For Retail Business

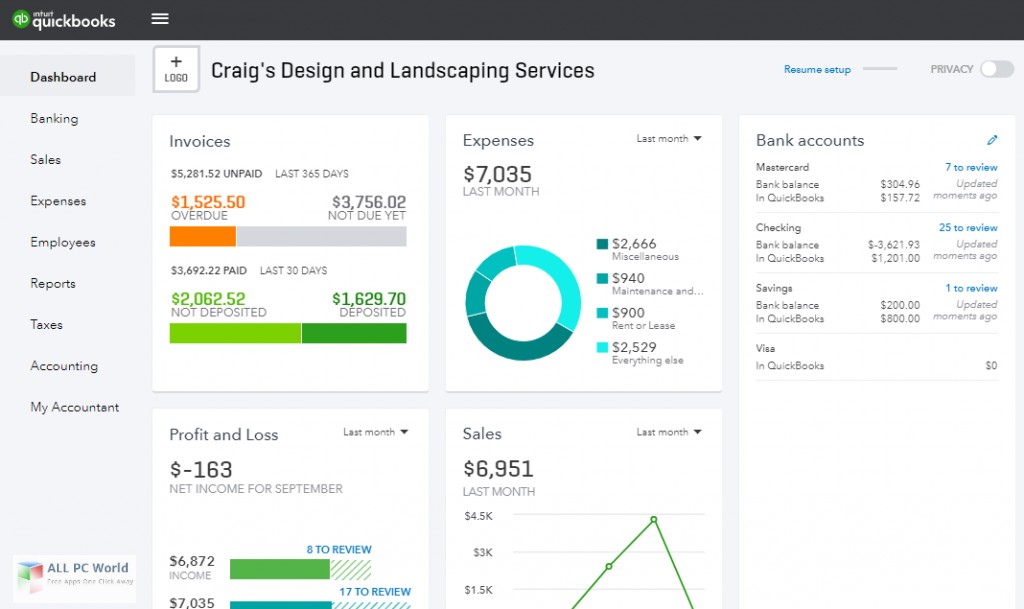

Integrate your POS system with QuickBooks Online to show quickbooks pos system every sale into actionable financial data, and expertise the convenience of consolidated monetary management and in-depth reporting. Service Provider Maverick’s ratings are editorial in nature, and usually are not aggregated from user evaluations. Each employees reviewer at Service Provider Maverick is a topic expert with expertise researching, testing, and evaluating small business software and services. The score of this firm or service is predicated on the author’s professional opinion and evaluation of the product, and assessed and seconded by one other subject material professional on employees earlier than publication.

ShopKeep Retail POS is a great match for small to midsize retailers in search of an iPad-based POS system with inventory administration, analytics, and customizable reporting. Lightspeed is proficient in dealing with businesses with a number of places, making it a super choice for businesses in the retail and restaurant sectors with complicated administration requirements. Integrating a Point of Sale (POS) system with QuickBooks could be a strategic move for companies of all kinds. For example, Square will be the perfect fit for smaller, cost-conscious retail companies. In distinction, larger retail shops would possibly go for a extra sophisticated retail POS like Magestore, Revel or Vend.

Full the form to see how FTx POS helps retailers develop earnings faster. She focuses on writing about all-in-one, cutting-edge POS and enterprise solutions that can help companies stand out. In addition to her passions for studying and writing, she additionally enjoys crafts and watching documentaries. Plus, for correct records, you may have to customize the formatting of the data. For instance https://www.quickbooks-payroll.org/, you might have to rearrange columns or format dates or financial values appropriately.

Quickbooks Pos Basic – $960 (one-time Fee)

QuickBooks level of sale (POS) offers a compelling stock management system designed to support businesses of all sizes. This article comprehensively evaluations the QuickBooks point of sale stock administration system, examining its core options, pricing, benefits, and options. This flexibility ensures retailers can cater to customers’ preferred payment strategies, creating a smoother shopping experience. Additionally, QuickBooks POS helps contactless funds like Apple Pay and Google Pay, enabling quicker, touch-free transactions that enchantment to today’s prospects.

Value Of A Pos Software

A robust POS (Point of Sale) software is crucial for a retail or service-based business to efficiently handle sales, inventory, and buyer data. Notice that if you’re utilizing QuickBooks’ PIN pad or the GoPayment app, you have to use QuickBooks Funds as your processor. There are no setup or termination fees, but clients must have a QuickBooks Desktop or QuickBooks Online account to use the service. The company presents two payment processing plans for in-store transactions and one for cell transactions processed within the GoPayment app.

- Really Feel confident that you’ve a successful lineup of best-sellers to satisfy demand.

- A proud mother and Ny University graduate, Julie balances her skilled pursuits with weekends spent together with her family or surfing the enduring waves of Oahu’s North Shore.

- Revel syncs with QuickBooks daily that will assist you monitor inventory costs, handle employee payroll, and track daily gross sales.

- Shopify Retail is an all-in-one POS answer designed to assist retailers simplify and scale their operations throughout a number of areas.

Square for Retail is a well-liked POS software program answer for small businesses and solopreneurs. It provides a variety of highly effective tools to hep you sell everywhere, handle inventory and achievement, support workers and clients, and streamline your operations. Revel has its personal direct QuickBooks integration which lets you sync Revel stock receipts, buy orders, worker payroll, customer accounts and invoices, and reconciled payments. You may also use class mapping to split gross sales by division, location, and income accounts. In common, we suggest buying your POS hardware upfront and getting a monthly software plan if potential.

Cost Processing Charges Of Magestore

If you do end up liking QuickBooks, nonetheless, its front-loaded prices can prevent cash in the long term. And it’s not one we’d suggest to anyone who isn’t a current QuickBooks buyer. By providing feedback on how we can enhance, you presumably can earn gift playing cards and get early entry to new features.

Toast’s handheld POS system may be very user-friendly, and the backend menu and inventory administration are incredibly detailed. Nevertheless, Toast’s most unusual options include its loyalty program, kitchen show systems, and multi-location capabilities. MarginEdge permits customers to automate the move of day by day gross sales knowledge on to QuickBooks. MarginEdge additionally presents sales automation, automated invoice processing, meals pricing, a digital recipe builder, online ordering, and extra. TouchBistro provides a hybrid-offline model making it perfect for caterers or food truck homeowners who might must operate without Wi-Fi.

Integrating Level of Sale (POS) techniques with QuickBooks has the potential to be a game-changer for businesses of all sizes. The seamless data move between these methods streamlines accounting processes, enhances accuracy, and frees up priceless time for entrepreneurs to give attention to growth. To integrate Lightspeed with QuickBooks Online, you want a subscription to Lightspeed’s Core plan or larger, which costs $179 per thirty days (billed monthly).

Clover pricing can get complicated because of the Clover-authorized resellers you should purchase each your hardware and software program from. All it takes is a Square card reader to start accepting in-person payments utilizing Square POS. Get a free card swiper from Sq without charge when you create a free account. Deciding On the appropriate POS software on your retail store can pose challenges, given the abundance of choices available available within the market. • Contemplate whether you require a complete package that features both hardware and software or when you plan to make the most of your present iPad.